Jumbo Loan Rates & Limits

Jumbo loans provide a financial solution for homebuyers looking to purchase high-value properties that exceed the loan limits established by the Federal Housing Finance Agency (FHFA) for conforming and super-conforming mortgages. Here's a concise overview of what jumbo loans entail:

Definition and Purpose

Requirements

Characteristics

Suitability

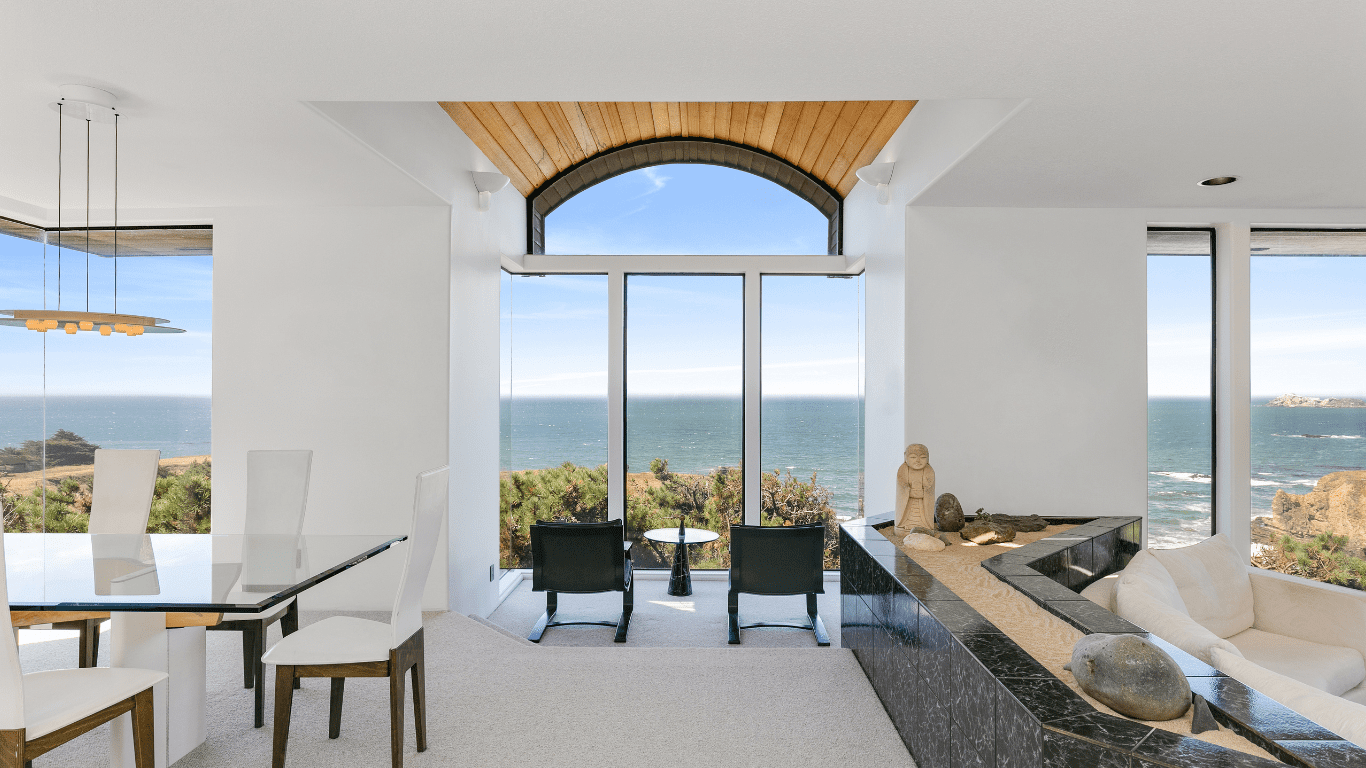

Jumbo loans are particularly suited for borrowers who are financially secure, with substantial incomes, strong credit histories, and the ability to make larger down payments. They are essential for purchasing luxury properties or homes in highly competitive real estate markets where prices exceed the conforming loan limits.

Choosing a jumbo loan involves careful consideration of the financial commitment it entails, including the ability to afford higher monthly payments and meet the stringent qualification criteria set by lenders.

Picking The Correct Jumbo Mortgage

Securing a jumbo mortgage can be a strategic move for those with strong financial foundations, aiming to purchase higher-priced homes that exceed conventional loan limits. Here's how to navigate the process and what to consider:

Qualification Criteria

Loan Options

Jumbo loans come in both fixed-rate and adjustable-rate (ARM) formats, each with its benefits depending on your financial goals and risk tolerance.

Fixed-Rate Jumbo Loans

Adjustable-Rate Jumbo Loans (ARMs)

Initial Fixed Period: ARMs typically start with a lower interest rate than fixed-rate mortgages, fixed for a preliminary period.

Popular Jumbo ARM Types

Choosing Between Jumbo ARMs and Fixed-Rate Loans

Strategy and Considerations

When opting for a jumbo ARM, closely examine the interest rate caps to ensure you can handle potential increases. If your plan involves selling or refinancing before rate adjustments begin, an ARM could offer significant savings over a fixed-rate jumbo mortgage. However, this approach requires careful consideration of market conditions, interest rate trends, and your future financial stability.

In summary, jumbo loans, whether fixed-rate or ARM, expand purchasing power for high-value properties, making them ideal for financially secure buyers looking for luxury homes or properties in competitive markets.

Why are Jumbo Loan Rates Higher Than Conventional Loans?

Jumbo loan rates tend to be slightly higher than conventional mortgages because of the higher risks that lenders face.

Unlike conventional mortgages, Fannie Mae and Freddie Mac can’t service jumbo loans.

If someone with a conventional mortgage defaults on their loan, Freddie Mac and Fannie Mae will buy the defaulted loan from the lender. By contrast, if someone with a jumbo loan defaults, whichever entity owns the loan at the time will bear all of the loss.

This is why lenders have more stringent qualifying requirements for borrowers who want to get jumbo loans than for those who want to buy a home with a conventional mortgage. They also typically charge higher rates of interest for jumbo loans than for conventional or government-backed mortgages.

Can I Qualify for a Jumbo Loan With a Lower Down Payment?

If you want to buy a home that exceeds the conforming or super-conforming loan limit in your county with a mortgage, you’ll be expected to have a larger down payment than for a different type of mortgage.

Lenders typically require a minimum of 10% down for jumbo loans. However, some lenders require a minimum down payment of 25% or more to purchase a home with a jumbo loan.

Some lenders also expect you to have enough money in your cash reserves to afford your mortgage payments for at least 12 months.

Will I Be Able To Refinance a Jumbo Loan?

While it’s possible to refinance a jumbo loan, lenders are much pickier when deciding whether to approve a refinance of a jumbo mortgage vs. another type of home loan.

Expert mortgage lender can help you search for a lender willing to refinance a jumbo loan for you. You can anticipate needing a higher credit score based on your loan type (fixed vs. ARM), loan length, and property type.

Your DTI will also need to meet the lender’s requirements for a jumbo loan refinance.

Is there a Jumbo VA loan?

If you are a military veteran who is eligible for a VA loan, you can get a VA jumbo loan with multiple advantages and benefits over standard jumbo mortgages.

VA loans don’t have a maximum limit for those with full entitlement, are backed by the Department of Veteran Affairs, and have lower interest rates and down payment requirements.

If you have full entitlement, the VA will back the same percentage of your mortgage regardless of its size.

If you have partial entitlement, lenders will typically determine a loan maximum based on one of the two following formulas:

- With a down payment – (Entitlement you have left + Your down payment/equity) multiplied by four

- Without a down payment – With partial entitlement and no down payment, your maximum VA loan amount will be the amount of your remaining entitlement multiplied by four.

VA jumbo loans have looser credit and down payment requirements, but they can only be used to purchase a primary residence. The home must also pass safety inspections.

Jumbo Loans Through Mortgage Brokers vs Lenders

If you’re looking for a jumbo loan, Expert mortgage lender can find multiple offers from different lenders, allowing you to compare terms and interest rates and find the best deal.